Types of mortgages for buying a house in the Netherlands

You will only receive a tax reduction if the deductible financing interest and fees exceed the amount added to your income for the imputed rental value of your home. If your taxable income in 2021 exceeds €68,507 (€69,398 in 2022), it's important to note that you can offset the deductible mortgage interest at a maximum rate of 43% in 2021.

Mortgage Interest Tax Deductions 101 (Updated for 2024)

In 2023, you took out a $100,000 home mortgage loan payable over 20 years. The terms of the loan are the same as for other 20-year loans offered in your area. You paid $4,800 in points. You made 3 monthly payments on the loan in 2023. You can deduct $60 [ ($4,800 ÷ 240 months) x 3 payments] in 2023.

Mortgage interest rates in the Netherlands are at record low Yktoo

Netherlands Individual - Deductions Last reviewed - 09 January 2024.. The result is that in the year 2024 the mortgage interest paid can be deducted against a (maximum) tax rate of 36.97%. Personal allowances. Generally speaking, there are no standard personal allowances in the Netherlands. Nonetheless, there are levy rebates that lower the.

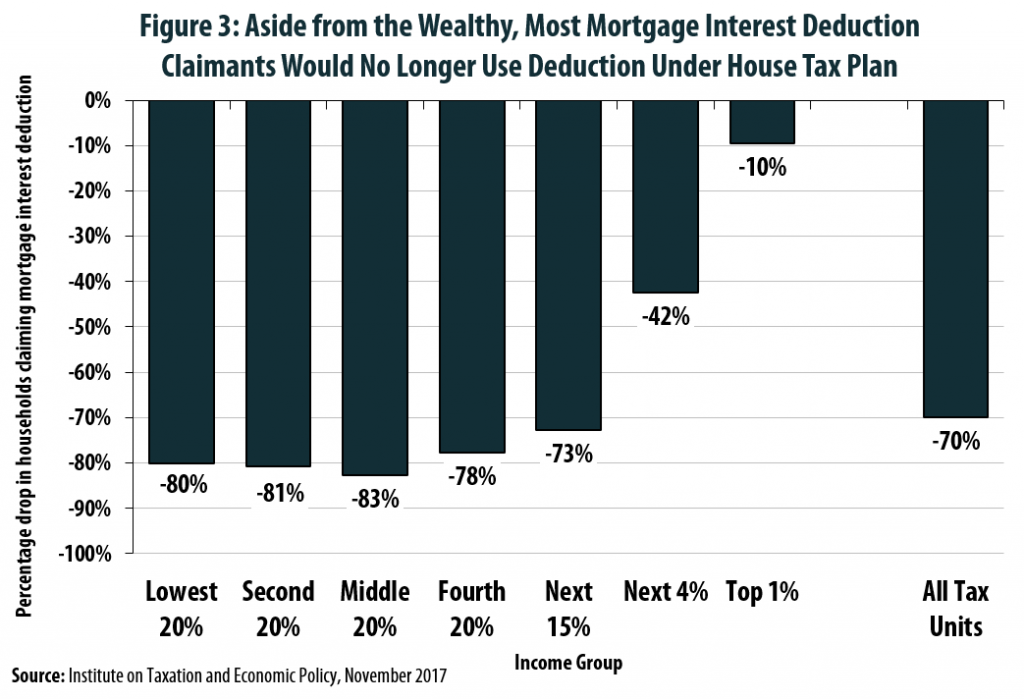

Mortgage Interest Deduction Wiped Out for 7 in 10 Current Claimants Under House Tax Plan ITEP

DGA Minimum Wage Fiscal year and tax changes in the Netherlands Account in the payment system for business Rules for the distribution of work and rest in the. Worldwide income statement School holidays 2023-2024 Weekends and holidays 2024 Minimum wage 2024 How to notify the. To qualify for a tax deduction on mortgage interest, you must.

Current Mortgage Interest Rates October 2022 (2024)

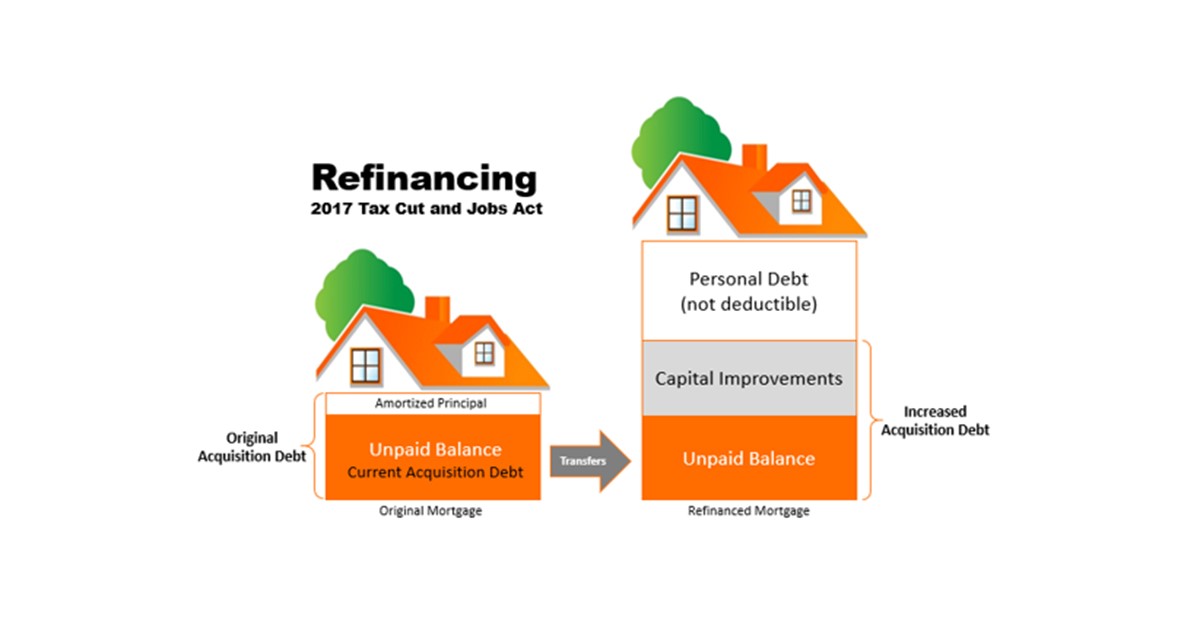

If you purchased your home before Dec. 16, 2017 and are a single or joint filer, you can deduct interest paid on the first $1 million of your mortgage. If you are married and filing separately.

Types of mortgages in the Netherlands Dutch ‘hypotheken’ explained LaptrinhX / News

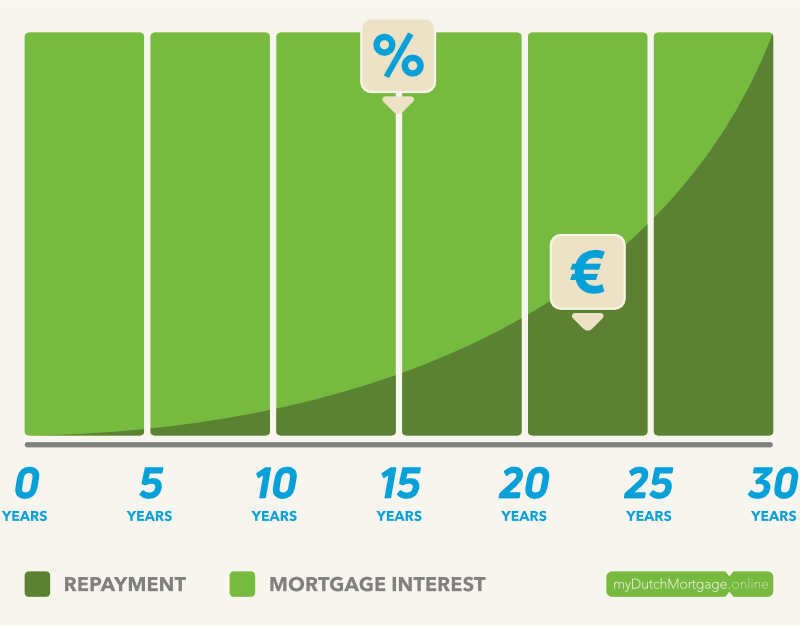

The process of mortgage interest deduction is simple. You pay monthly mortgage interest to the financial institution where you took out your mortgage. You can then deduct this paid interest from your taxable income when you file your tax return. The deductible amount depends on the tax rate applicable to your income.

Understanding the Mortgage Interest Deduction The Official Blog of TaxSlayer

Mortgage interest deduction limit. You can deduct the mortgage interest you paid during the tax year on the first $750,000 of your mortgage debt for your primary home or a second home. If you are.

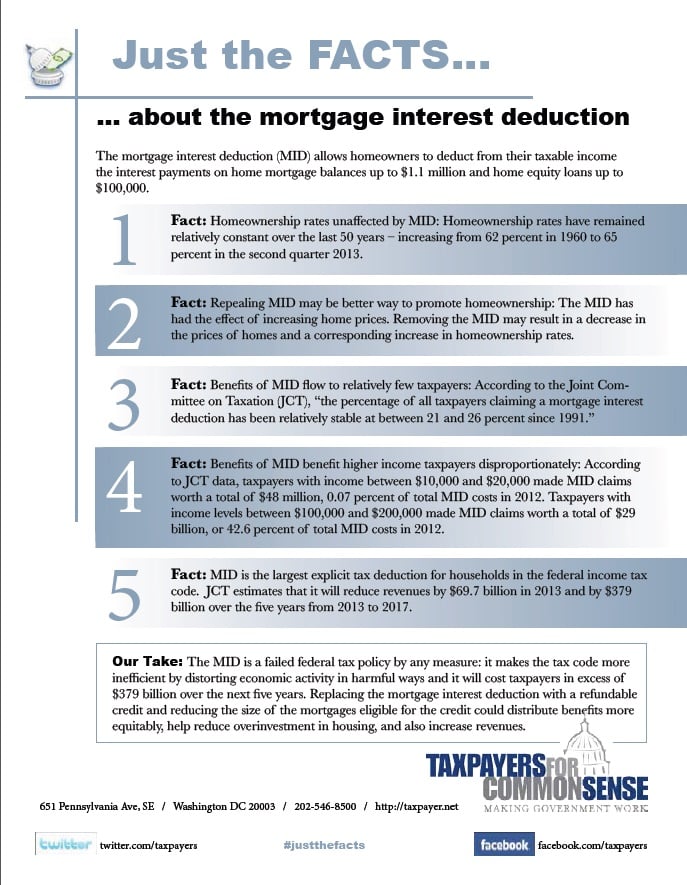

Mortgage Interest Deduction Time for Reform Taxpayers for Common Sense

The Interest Deductibility Scheme from 2014 up until 2023 in the Netherlands. The maximum mortgage interest deduction for those with higher incomes has been scaled away beginning on January 1, 2014, by 0.5% per year. The Tax Authority has sped up the phaseout by an extra 3% each year beginning in 2020. The deduction for mortgage interest is now.

Mortgage Rates Netherlands 2022

4.79%. 4.86%. Show all terms. Bridging Loan 5.90%. ABN AMRO ensures that the interest rates shown are as reliable and up to date as possible. If something goes wrong causing the interest rates shown to be incorrect, we cannot be held liable for any loss or damage you may incur as a result.

Understanding the Mortgage Interest Deduction RE/MAX Results

The maximum deduction rate is limited to 36.97% in 2024. This applies to the entrepreneur allowance, SME profit exemption, personal allowances, and paid mortgage interest. When you fill out the return, the rate is calculated automatically. The deduction limit does not apply to annuity expenses within the annual and reserve margin.

MortgageInterestDeduction1 The Official Blog of TaxSlayer

Overall conditions are favourable to buy a home in The Netherlands and we expect a price increase of 3% to 6% for 2024. The limit for NHG mortgages also increased to 435.000,- euro and if you are under 35 the starter exemption on transfer tax now applies to home purchases up to 510.000,- euro. Both the lower NHG rate compared to a normal.

Claiming The Student Loan Interest Deduction

As of January 1, 2024, the Box 3 tax rate increased from 32% in 2023 to 36%. The tax-free amount in Box 3 will not be indexed per January 1, 2024, however. This will remain €57.000 per person and €114.000 for fiscal partners. Box 3: Current affairs. Box 3 has been the subject of much debate in the Netherlands in recent years (and still is).

Keep the mortgage for the home mortgage interest deduction?

Here's what's changing in 2024: 1. The transfer tax discount will increase. One major change to mortgages in 2024 is regarding the transfer tax. People under the age of 35 do not have to pay transfer tax if they purchase a house for less than 510.000 euros. However, this only counts if you haven't made use of this advantage in the past.

How Can The Deduction Of Mortgage Interest Help Financial Situation Blog The Tech

From January 2022, the mortgage rate for a standard (non-NHG) mortgage application for a 10-year annuity mortgage has increased from 1.51% to 4.95% in November 2022 (ABN AMRO). The consequences are big for the monthly costs. For the first month (no repayment yet), the gross mortgage rate (before mortgage interest deduction) increases by 228% on.

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax

In 2024, the property transfer tax for first-time home buyers will rise from €440,000 to €510,000. First-time home buyers between 18 and 35 years old can enjoy a 2% transfer tax exemption on their initial property purchase price of up to and including €510,000. For real estate investors, this exemption does not apply.

Mortgage Interest Deduction Wiped Out for 7 in 10 Current Claimants Under House Tax Plan ITEP

One of the benefits of the Dutch system is that some closing fees are tax-deductible in the Netherlands. A week before you need to sign a mortgage deed, your notary sends you a list of closing fees you must pay to secure a mortgage. However, not all the costs are tax-deductible on the final invoice. You can get approximately 40% back when you.