dutch salary calculator DrBeckmann

About 30% Ruling. The salary criteria for the 30% ruling as per January 2023 are as follows:. The salary amount does not matter if working with scientific research. The annual taxable salary for an employee with a master's degree and who is younger than 30 years, must be more than 31,891 (2022: 30,001).; The annual taxable salary for other employees must be more than 41,954 (2022: 39,467).

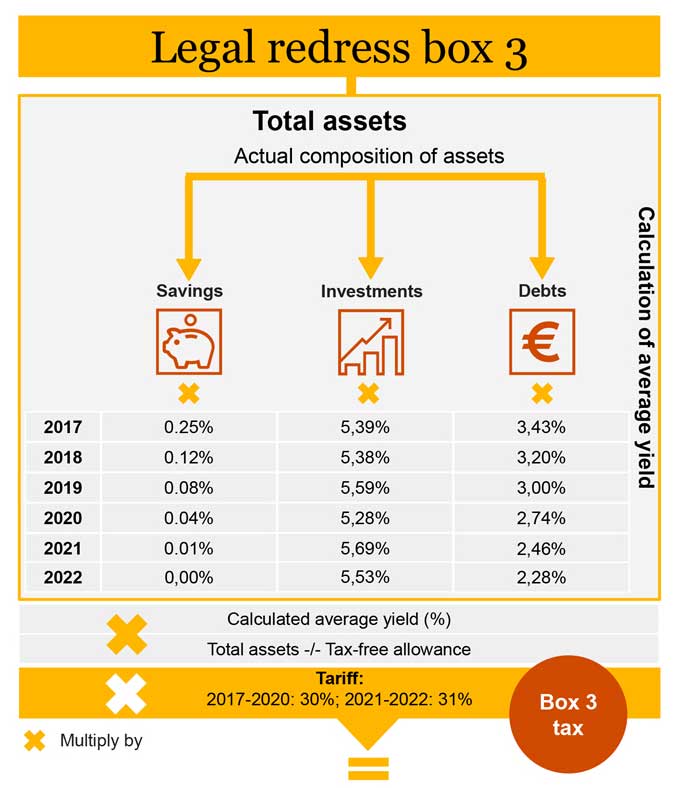

Box 3 Guide Tax Our services PwC

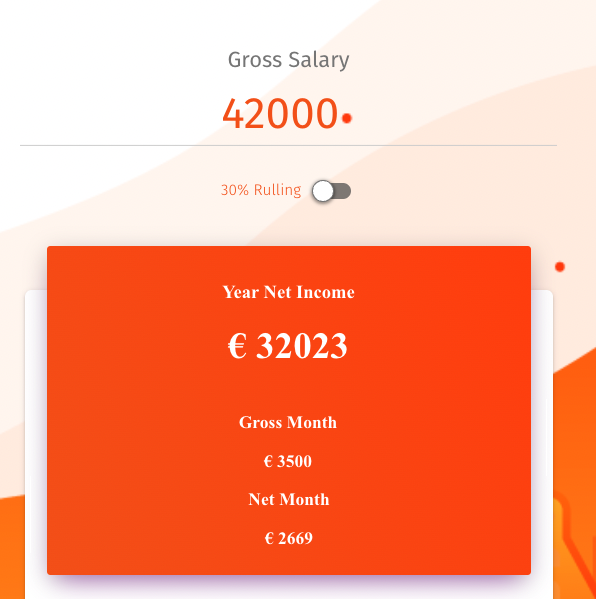

Learn how your Dutch taxes look like for 2023 & 2023 with a Salary Calculator. Get info on your monthly Net or Gross income after Taxes. Visual representation Net vs Gross Income. A tax calculator that visually presents net and gross income out of a total sum allows individuals to easily determine the percentage of their income that goes.

Dutch Tax Calculator ODINT Consulting

Select the year for which you would like to calculate the Dutch income tax. Calculator for 2024 Calculator for 2023 Calculator for 2022 Powered by Blue Umbrella

1 The Dutch tax system 2015 Download Table

The calculation is an illustration based on various assumptions and is meant to provide an indication of what you may take home as net pay. For a more detailed projection please contact our customer support by clicking on the "Speak to an Expert" button above. Tel: +86 21 5269 8801. Tel: +601 66999095. Dutch salary and tax calculator for.

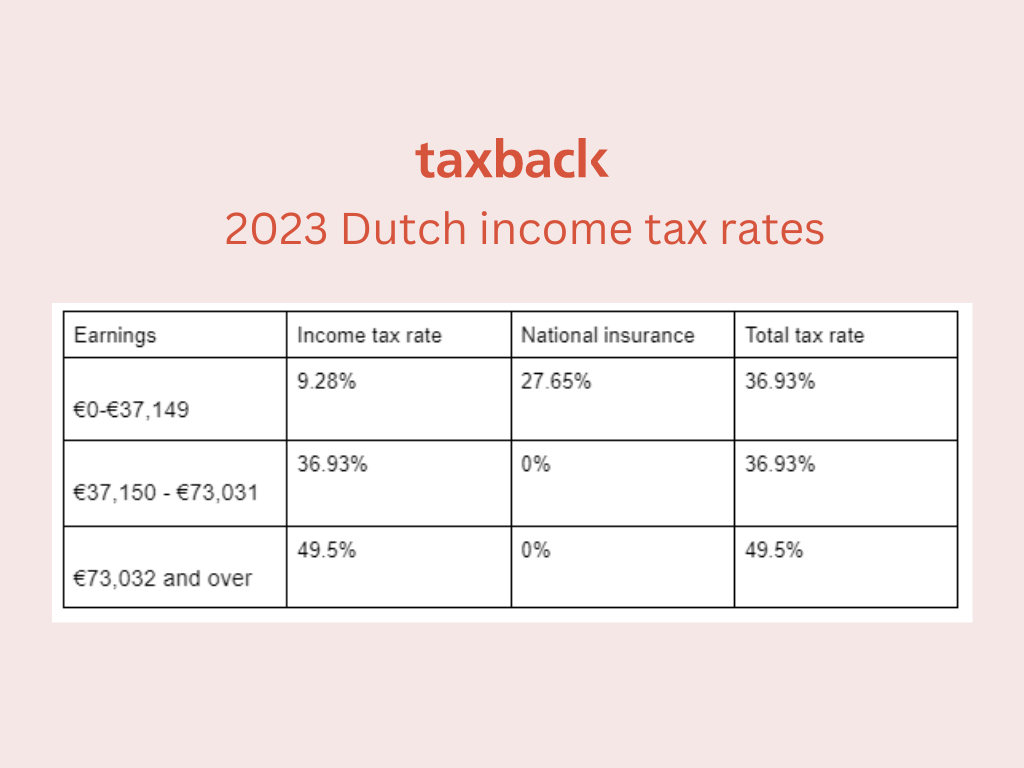

The Dutch Tax System An Overview for Expats and Entrepreneurs Dutch Tax Calculator

There is an annual exempt amount of €57,000. This is the exempt amount for box 3 in 2024. The 2024 tax rate in box 3 is 36%. In 2023, it was 32%. How to calculate (notional) returns has been the subject of much debate in recent years. Since 2023, the Box 3 Bridging Act applies.

Netherlands Corporate Tax Calculator 2022 ODINT Consulting

New York Income Tax Calculator 2023-2024. Learn More. On TurboTax's Website. If you make $70,000 a year living in New York you will be taxed $11,074. Your average tax rate is 10.94% and your.

Dutch Taxes Explained Your Essential Guide to Taxation in the Netherlands

The Netherlands Tax Calculator below is for the 2024 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in Netherlands. This includes calculations for. Employees in Netherlands to calculate their annual salary after tax. Employers to calculate their cost of employment for their employees in Netherlands.

How to read (and understand!) your Dutch payslip DutchReview

The calculator is updated with the latest tax rates and brackets as per the 2024 tax year in Netherlands. This tool is designed for simplicity and ease of use, focusing solely on income tax calculations. For a more detailed assessment, including other deductions or specific tax advice, consult a tax professional.

Dutch taxes explained the Mform YouTube

The New York tax calculator is updated for the 2024/25 tax year. The NY Tax Calculator calculates Federal Taxes (where applicable), Medicare, Pensions Plans (FICA Etc.) allow for single, joint and head of household filing in NYS. The New York income tax calculator is designed to provide a salary example with salary deductions made in New York.

How To Calculate Tax 2023 24 Ay 2024 25 Tax Calculation Explained In Hindi Otosection

Income tax calculator Netherlands. Use our Dutch tax calculator to find out how much income tax you pay in the Netherlands. Check the ' I enjoy the 30% ruling ' and find the maximum amount of tax you can save with the 30 percent ruling . Sole traders (self employed) receive additional tax credits lowering the total amount of tax paid.

GitHub Dutch Tax Calculator with AngularJS

The tool is for everyone with an income taxed in box 1 of the income tax. That means, self-employed professionals without staff (zzp'ers), eenmanszaak owners, and director-major shareholders (DGA's). The income tax rates change every year. Check the effect of the 2024 rates on your income.

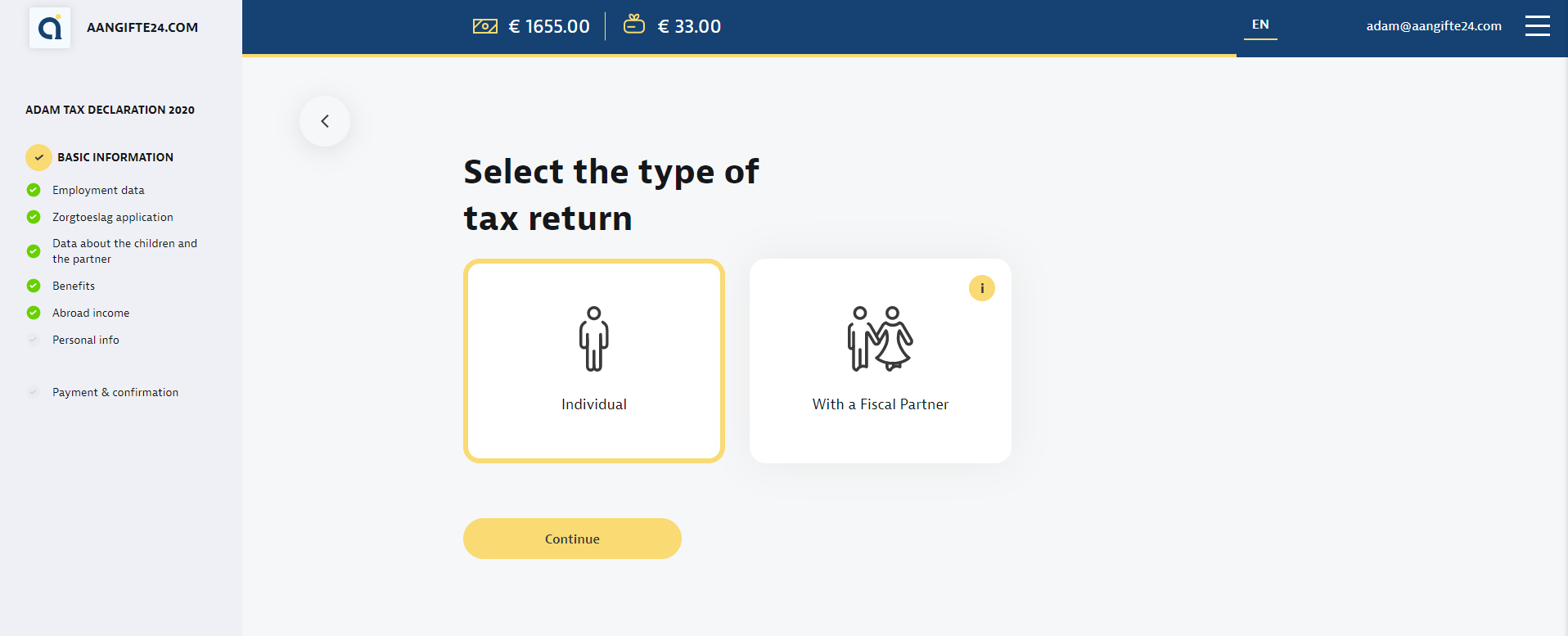

Netherlands Tax Calculator online Aangifte24

Dutch income tax calculator, for free in under 1 minute. Through the tax calculator you can calculate the income tax on your Dutch income for all years, including 2024. You can calculate the income tax on your Dutch income from employment and as an independent entrepreneur (zzp). Completely free tax calculation. Need help or have any questions?

Dutch declaration for Belgian crossborder workers Grenzinfopunkt

New York State Tax Quick Facts. State income tax: 4% - 10.9%. NYC income tax: 3.078% - 3.876% (in addition to state tax) Sales tax: 4% (local tax 3% - 4.875%) Property tax: 1.73% average effective rate. Gas tax: 25.35 cents per gallon of regular gasoline, 23.7 to 25.3 cents per gallon of diesel. For taxpayers in the state of New York, there's.

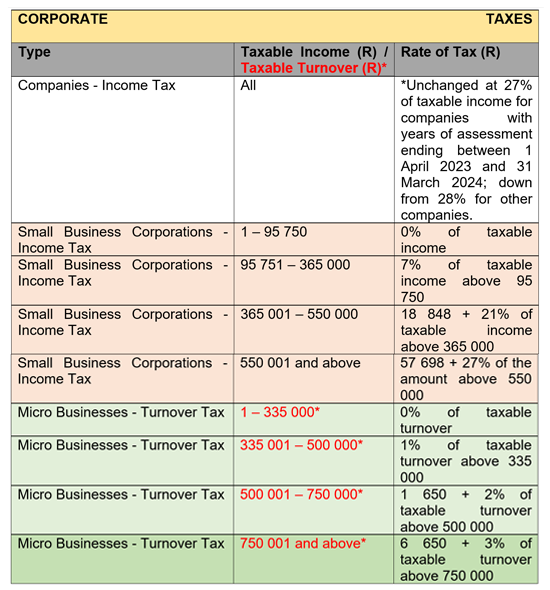

Budget 2023 Your Tax Tables and Tax Calculator Amods Accounting

Salary Calculator Results. In the Netherlands, if your gross annual salary is €45,400 , or €3,783 per month, the total amount of taxes and contributions that will be deducted from your salary is €11,641 , without accounting for the 30% ruling . This means that your net income, or salary after tax, will be €33,759 per year, €2,813 per.

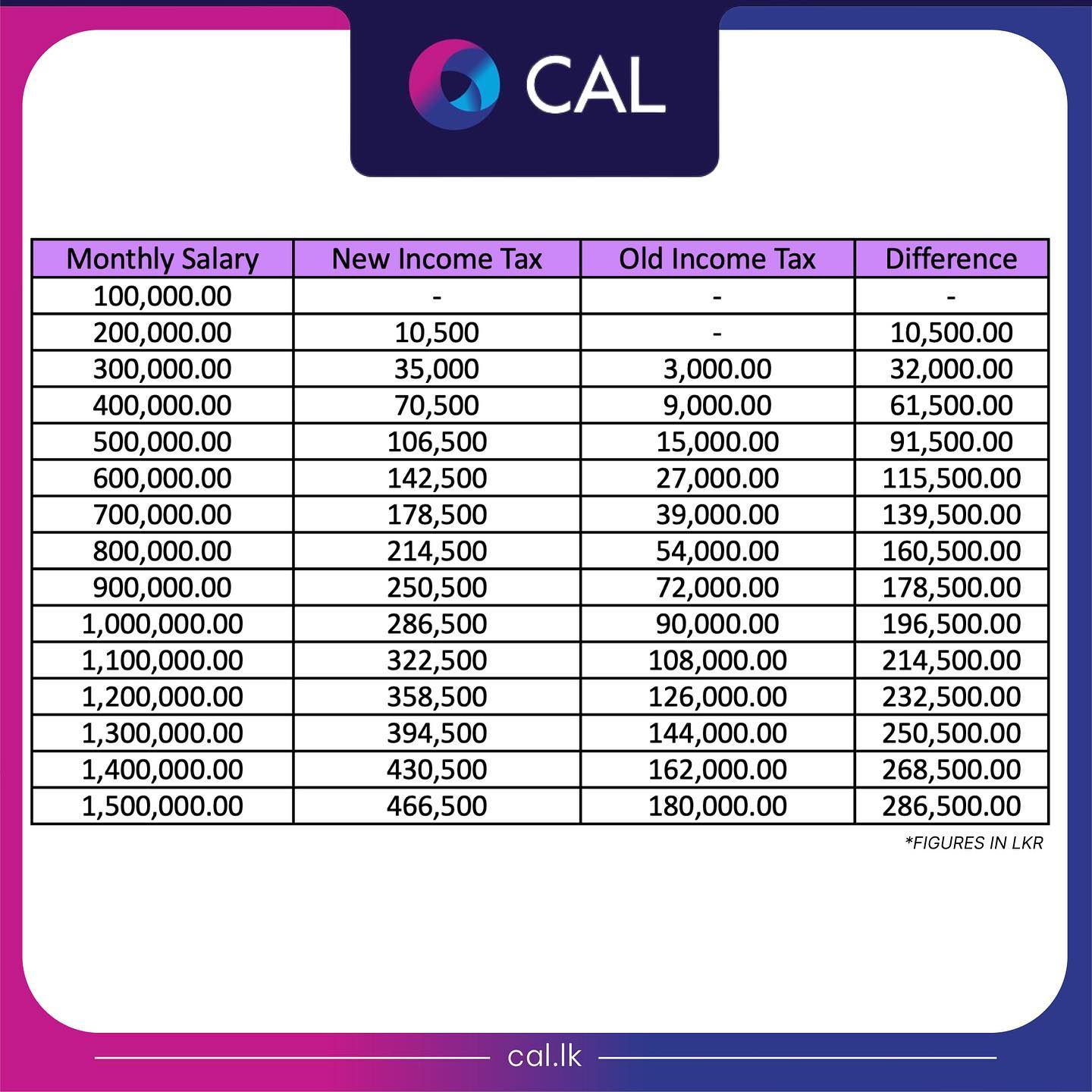

How do the new personal tax rates affect you? CAL

About 30% Ruling. The salary criteria for the 30% ruling as per January 2024 are as follows:. The salary amount does not matter if working with scientific research. The annual taxable salary for an employee with a master's degree and who is younger than 30 years, must be more than 35,048 (2023: 31,891).; The annual taxable salary for other employees must be more than 46,107 (2023: 41,954).

Netherlands Tax Refund Average

49.5%. Income from € 75,518.01. and above. Netherlands Non-residents Income Tax Tables in 2024. Personal Income Tax Rates and Thresholds (Annual) Tax Rate. Taxable Income Threshold. 9.32%. Income from € .000.00.